Fast Track Blog

Why You Might Spend Too Much on Housing and How to Reduce Your Housing Cost

Table of Contents

How Much Do You Spend On Housing

The rental prices in big cities around the world are increasing over the years and it has occupied a large percentage of the salary. For example, in London, the average cost of rent is more than 41% of the salary in 2017. According to CNBC Make It, millennials would have spent $97,000 on rent before they turn 30.

The forecast has shown that Generation Z would spend even more. Why we are spending more and more on rent besides inflation?

Here is a list of the top 10 most unaffordable cities to rent a home, according to Business Insider:

-

San Francisco: the average proportion of wage spend on rent is 47%.

-

London: the average proportion of wage spend on rent is 45%.

-

Hong Kong: the average proportion of wage spend on rent is 44%.

-

Tokyo: the average proportion of wage spend on rent is 42%.

-

New York City: the average proportion of wage spend on rent is 40%.

-

Rome: the average proportion of wage spend on rent is 40%.

-

Singapore: the average proportion of wage spend on rent is 40%.

-

Amsterdam: the average proportion of wage spend on rent is 37%.

-

Geneva: the average proportion of wage spend on rent is 33%.

-

Nice, France: the average proportion of wage spend on rent is 33%.

Although you may have heard that the general rule is not to spend more than 30% of your salary on housing, in those cities, people have to spend more than 30% of their pre-tax income. There might be in other less expensive cities, some people are still spending more to have a nice home.

Why People Spend So Much On Housing

One of the most obvious reasons is that many can not afford to buy. In cities like New York, Singapore, or San Francisco, buying an apartment costs hundreds of thousands to millions. Some require a high downpayment such as Switzerland (20%), China (20%, 50% in some cities). Besides the mortgage would be heavy on the shoulders if the interest rate in your country is somewhat “heavy”. Then the monthly payment would be more or less the same as a rental, but you then have to bear a long-term debt and put large lump sum upfront.

Economic reason aside, having a comfortable home gives people a sense of security and calmness. Home is where you rewind and relax. This emotional fulfillment can not be put a price tag on to many people. Therefore, for most, if they can afford a place where they feel truly comfortable, they are willing to up the budget. Hence some pay even more than 50% of their salary on housing.

How To Reduce Housing Cost

If you are serious about saving and investing and build up your wealth, you should have a second look at your housing options. Do you really need that perfect home? Do you really need an additional room for guests? Do you really need to live in that fancy neighborhood?

There are so many wrong reasons for us to inflate our housing costs which could be put into work and generate more income for us in the future. I like to go back to the savings calculator. If you can remove the inflations such as additional rooms, prime locations, luxury standards. You can save for sure a lot each month. then you put these savings into an ETF or an investment over the long term which generates an average of 8% annual return, how much would you have in 10, 20 years?

Let’s take Singapore for example.

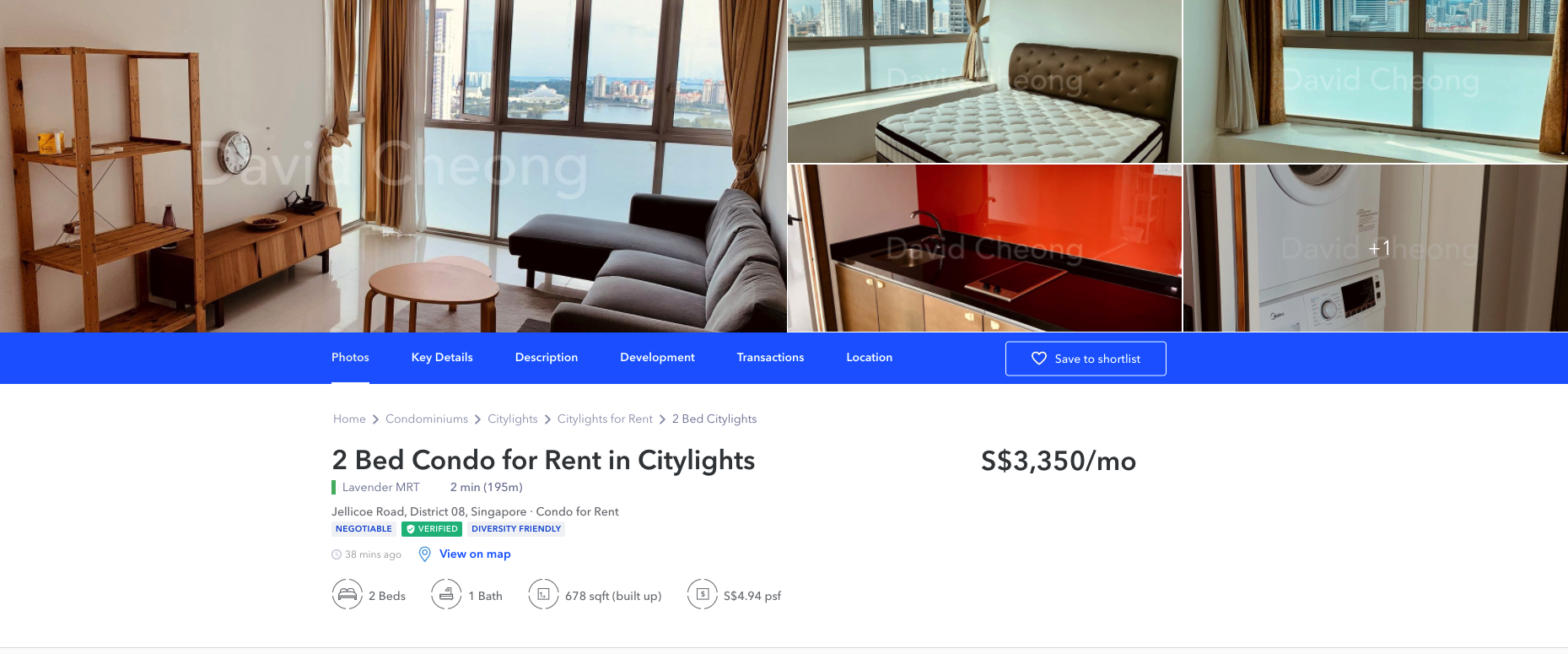

source: 99.co

A 2bedroom condo near the city center costs S$3,350 per month.

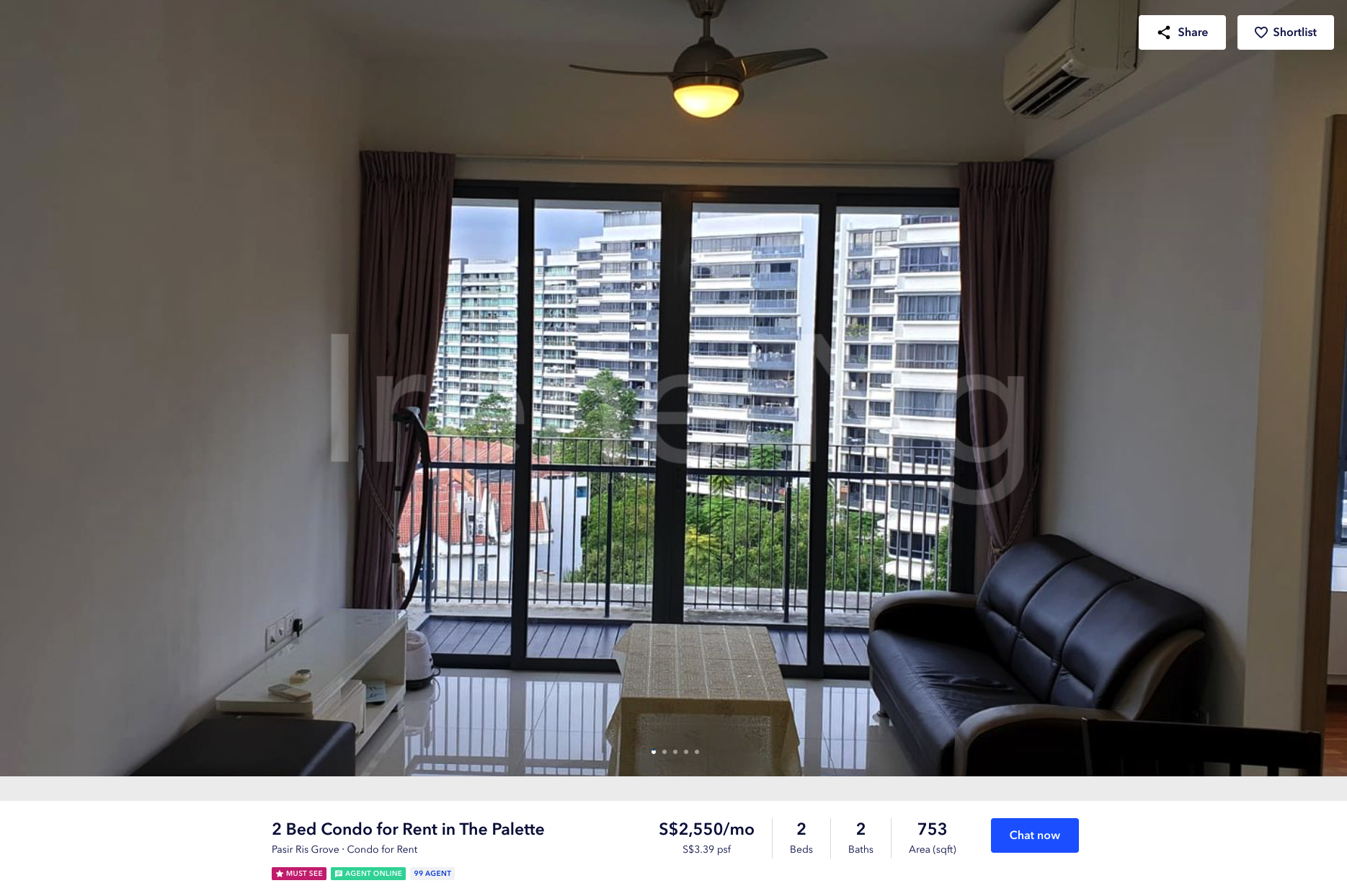

source: 99.co

A 2 bedroom condo 27mins MRT ride away from the city center costs S$2,550.

If you move from one to another, with no change of apartment standard or whatsoever, the immediate saving is S$800 per month, S$9,600 a year. Let’s put this amount to work.

source: saving.org

In 10 years, you would have S$139,071. Let’s say you optimize your internet cost, utility cost, and find an even cheaper place to rent. Your investment from the savings will grow to a much bigger amount. After 10years, you can even choose to buy one apartment if that is a better option. But if you spend so much on housing every month, you might jeopodize the potential of owning a property or a greater net worth in the future, while you are not lowering your living standard.

By moving to another apartment is one simple example of how you can immediately save more, there are more actions you can take to reduce housing costs. It is a one-time effort only, but you benefit from it every month.

My favorite question to people is how much they spend on the internet. Surprisingly, most spend double as we do while having the same internet speed. You never know where you can optimize unless you start examining them.

Go through each expense of housing-related cost, ask yourself, do you really need those? how can you reduce them?

-

rent

-

insurance

-

internet

-

cleaning service

-

gardening

-

…

It always occurs to me that when we have to pay so much for our homes, we have to work hard and earn a high salary to maintain them, then who gets to enjoy the home since we will be at work most of the time?!

Instead of working for your home, let your money work for you.

What is the average rent in your city? How much of your salary do you spend on housing?

Related article: <Why Your Real Hourly Rate Is Only Less Than 50% of What You Are Paid>

Net Worth Tracking Tool: Download a free net worth tracker here.

Share this post

Latest Blog Posts

Money Mindset

January Expense for a Family of 2 in Switzerland

Read MoreMoney

The Cost of Having a Baby in Switzerland

Read MorePersonal Finance

3 Things You Need To Know Before Buying a Property in Switzerland

Read More