Trading vs. Investing

When you talk about investing, a lot of people might associate it with trading. Some might started investing money into the market, but they are doing it as if they are trading the stocks, not investing in the stocks. Here is the difference between trading and investing:

Trading:

According to Nerdwallet.com, Stock trading involves buying and selling stocks frequently in an attempt to time the market. So the goal of stock traders is to capitalize on the short-term market events to sell the stocks for a profit or buy them at a low price. Traders buy and sell stocks multiple times in a day. It is not only limited to the trader, individual investors can also trade stocks. But as you might imagine, you need to understand the market pretty well and dedicate a lot of time to it. Compared to a full-time professional trader, an average investor is nowhere near that level.

Probably this is why when people started investing, they behave like traders, buy and sell frequently and try to time the market. But what they should do instead, is to invest, not trade.

If you have tried trading, do you make money most of the time or lose money? Do you need to spend a lot of time and energy read the news and study the markets?

If you have not started, are those reasons prevent you from investing? When you understand what is investing, maybe you will change your mind.

Investing:

According to the Cambridge Dictionary, investing means buying something that you think will go up in value, for example, shares or property, in order to make a profit. Investing is like you giving money to a company or an asset and hoping this asset will appreciate in value over time, then when you sell it, you make a profit. The main difference is that trading focus on the short-term gain by trying to time the market, investing is focusing on long term gain. This is what an average investor can achieve, identify assets that you think will go up in value, invest in them, and make a profit after some time.

When you trade, you try to take advantage of the volatility in the day, when you invest, you try to take advantage of the companies in the index going up in value over time. Which one is more practical for an average investor? Of course, the latter. When you invest in company stocks, the companies are working for you, they have the resources to grow their business and make profits. As an investor, you benefit from their growth. Or you invest in a real estate property, over time, the property value increased due to the development of the market or economy, then you can sell it for a profit.

It sounds easy, right? But still, how do you know when is the right time to buy? When is the right time to sell? Well, in most of the cases you don’t know, that is why you need to use dollar-cost averaging.

What is dollar-cost averaging (DCA)

Dollar-cost averaging (DCA) is an investment strategy that instead of buying assets (stocks) at one single time point with a large amount, you invest the same amount of money frequently in your targeting assets. You can do it weekly, monthly, or bi-monthly. In doing so, you are reducing the impact of volatility. When the price drops, you buy more shares, when the price increases, you buy fewer shares. But when the price increases, you gain more because you now have more shares at a higher price. Let’s see it in action.

Imagine you have identified an asset you want to invest in. By using dollar-cost averaging, you invest $100 per month.

In month 4 when the share price dropped, you bought more shares, 4 instead of 2. In month 2 when the share price increased, you bought fewer shares, 2. Again in month 6 the share price increased, but as you have more shares now thanks to the low price months, your total asset value is $802.78 even though you have only invested $600.

When you apply this method to a longer time horizon, if the asset value increases in the long term, despite the short-term volatility, your total asset value will be bigger than your initial investment.

This way, you eliminate the single market entry risk by slowly buying in over a longer period with at same frequency. You should not worry about the short term volatility and focus on the long term.

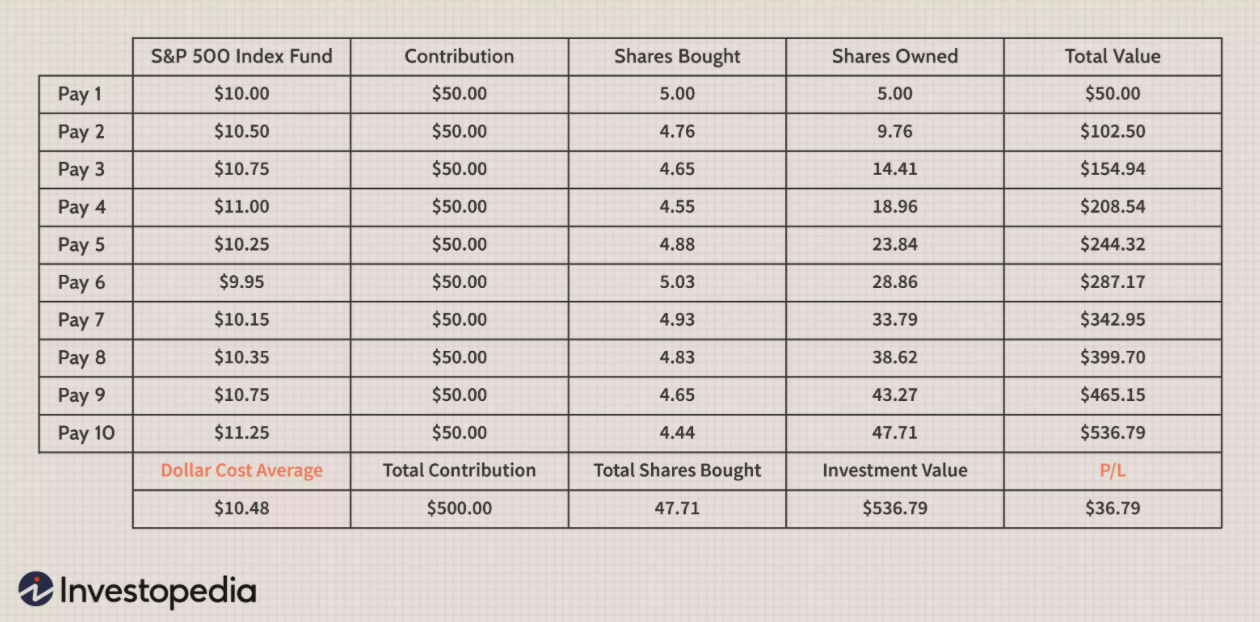

Now let us see a real example with the historical S&P500 index fund. Still, if you invest $100 per period, let’s say monthly. You will have below table:

Image by Sabrina Jiang © Investopedia 2020

The total investment is $500, the total investment value is $536.79. realized (if you sell it) is $36.79.

Volatility in a day vs. in 1 year, 5 years, and 22 years

Let’s look at the total world ETF from vanguard, this ETF includes more than 6000 company stocks and is very well diversified. It represents the market movement.

In a day, the chart looks like this: it goes up and down, with no obvious trend.

In a year, it looks like this:

In 5 years it looks like this: You can see the line is trending up despite some dips over the years.

In all time since 2008, it looks even more obvious that the line is smoother.

By using dollar-cost averaging, as long as the assets have a long term growth potential, you can grow your investment and reduce the market risks.

Conclusion

By using dollar-cost averaging, you can not only reduce market volatile risks but also grow your investment over time. There are many Rob-advisors or auto-invest services in the market, such as Trading 212, where you need to set your portfolio once and fix an investment amount and investment frequency, the program will help you buy the assets automatically. You basically don’t need to look at it or do anything else. Over 10, 20 years, you will have a much bigger portfolio value.

This article is to help you understand how dollar-cost averaging works and you should do your own research and study to decide what you want to invest and how you want to invest.

On the same topic, I highly recommend <The Bogleheads’ Guide to Investing>. This book explains clearly what is investing and how you should invest. Must read!

Related articles you might like:

Share this post

Latest Blog Posts

Money

The Cost of Having a Baby in Switzerland

Read MoreMoney

Avoid the 3 Most Common Mistakes When You Get Started With Investing

Read MoreMoney

Step by Step Guide To Decide Buy or Rent in Switzerland

Read More